Guide to Social Security Administration Background Checks

In this post we are going to look into the rules behind being a representative payee for someone who is entitled to social security benefit payments. These are people empowered to handle the finances of individuals who are unable to do so themselves due to disability. This is about the protections put in place against fraud and abuse of the intended benefit recipient.

What Is the Social Security Administration?

The social security administration (SSA) is an independent government agency that administers social security. It is an insurance program that consists of retirement, disability and survivor benefits. In order to qualify for these benefits most workers pay into the system through social security taxes.

The head offices of the social security agency are located in Woodlawn, Maryland and is referred to as the Central Office. There are tens of thousands of workers employed by the social security agency and it is the largest government program in the United States.

It is estimated that by the end of the 2022 fiscal year the agency will have paid out $1.2 trillion in benefits to 66 million citizens and legal residents of the United States. An additional 61 billion is expected in SSI benefits and 7.5 million to low-income individuals.

This government agency is a vital part of the country's economy and without it millions of already struggling Americans would have nothing. It is a program that many have paid into for decades in preparation for retirement and as an insurance policy against sudden disability.

History of the Social Security Agency

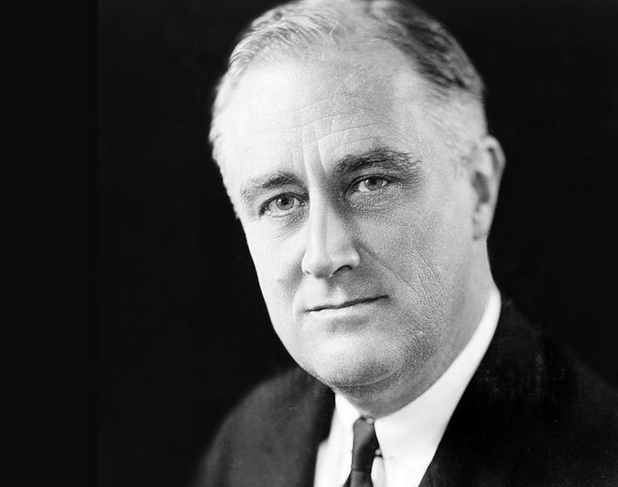

On August 14th 1935, President Franklin D. Roosevelt signed the Social Security Act into law as part of his New Deal initiative. This led to the creation of the Social Security Board (SSB), a presidentially appointed group of three executives tasked with overseeing the social security program.

With zero budget, staff or even furniture the SSB finally obtained funding from the Federal Emergency Relief Administration. It was on October 14th, 1936 that the first social security office opened its doors in Austin, Texas.

In January of 1937 social security taxes were first collected. Just a few years later the first social security check was issued to Ida Mary Fuller of Battleboro, Vermont. Ida’s check was dated January 31st 1940 and she received $22.54.

The SSB in 1939 merged with the U.S. Public Health Service, the Civilian Conservation Corp and other government agencies to become the Federal Security Agency. In 1846 under President Harry S. Truman the SSB was named the Social Security Administration SSA.

In 1953 the Federal Security Agency was dismantled and the SSA was placed under the banner of the Department of Health, Education and Welfare. Finally in 1994 President Bill Clinton made the Social Security Administration an independent body once again.

What Is a Representative Payee?

Representative payees manage the payment benefits for beneficiaries or recipients that are for some reason incapable of doing so themselves. This includes individuals with mental or physical impairment and covers all social security benefits due to the recipient.

Minors may also have representative payees up to the age of 18 unless otherwise deemed unnecessary. It may also continue beyond 18 if this best serves the interest of the beneficiary. The representatives may be an organization but can also be a family member or a trusted friend.

The representative payee is tasked with using the benefits in the best interests of the beneficiary and to officially report all expenditure (with certain exceptions) to the relevant authorities.

What Are Representative Payee Background Checks?

These background checks of representative payee applicants are not a new concept as some states have been testing this idea for several years. On 06/06/2023 however the Social Security Administration started blanket checks for applicants and currently serving representative payees.

These checks are to ensure that the individual has never been convicted of certain crimes which may point to their proclivity to abuse and defraud the individual of which they are being granted financial care.

Section 202 of the Strengthening Protections for Social Security Beneficiaries Act of 2018 (SPSSBA), Public Law 115-165, requires the Social Security Administration to:

conduct criminal background checks on payee applicants

prohibit the selection of certain payee applicants with a felony conviction of committing, attempting, or conspiring to commit certain crimes

conduct criminal background checks on all currently serving payees who do not meet one of the exceptions set out in the law, and remove and replace those with a felony conviction of committing, attempting, or conspiring to commit certain crimes by January 1, 2024

conduct ongoing criminal background checks, at least once every five years, on all currently serving payees who do not meet one of the exceptions set out in the law

Who Is Exempt from the Provisions of the Background Check?

Under section 202 of the SPSSBA there are certain individuals who are not required to pass the criminal background check. This is usually because there is a connection beyond the payee role that would indicate a responsibility of care for the benefit recipient. Those who do not need to pass the background check are:

- A custodial parent or grandparent of the individual being served be they a minor or a disabled adult

- A custodial spouse of the individual being served

- A custodial court appointed guardian of the individual being served

- A parent who was the payee for their minor child who has since reached 18 years of age but continues to be eligible for benefits.

- A person who has received a presidential or gubernatorial pardon for the disqualifying conviction

What Crimes Disqualify an Individual From Serving as a Payee?

There are currently 12 crimes for which a conviction of committing, attempting, or conspiring to commit would disqualify a serving or applying to serve person from acceptance. These crimes are serious and among some of the worst in society. The point being that convictions for such crimes mean the individual would possibly be a danger to the person they should be serving. The 12 crimes are:

- Human Trafficking

- False Imprisonment

- Kidnapping

- Rape and Sexual Assault

- First Degree Homicide

- Robbery

- Fraud to Obtain Access to Government Assistance

- Fraud by Scheme

- Theft of Government Funds

- Abuse or Neglect

- Forgery

- Identity Theft or Identity Fraud

Those convicted of participating in the crimes from the list above would be disqualified from continuing to serve or being approved to serve as a representative payee. As their responsibilities would be to vulnerable minors, seniors or those who are disabled this is a common sense and long overdue step.

Final Thoughts

Social Security Administration background checks are required for representative payees who are applying for or currently serving benefit recipients. These people control the money of people who are deemed unable to do so themselves so must be proven trustworthy. With this background check convictions related to 12 crimes can be disqualifying for holding this role as they may be a threat to the vulnerable benefit recipient.

Cite This Resource

Use the tool below to generate a reference for this page in common citation styles.

<a href="https://ssalocator.com/blog/guide-to-social-security-administration-background-checks.html">Guide to Social Security Administration Background Checks</a>

"Guide to Social Security Administration Background Checks." SSA Locator. Accessed January 6, 2026. https://ssalocator.com/blog/guide-to-social-security-administration-background-checks.html.

"Guide to Social Security Administration Background Checks." SSA Locator, https://ssalocator.com/blog/guide-to-social-security-administration-background-checks.html. Accessed 6 January, 2026.

Guide to Social Security Administration Background Checks. SSA Locator. Retrieved from https://ssalocator.com/blog/guide-to-social-security-administration-background-checks.html.