How to Prevent Social Security Fraud

What Is the Social Security Administration?

The Social Security Administration (SSA) is an independent government agency that administers social security. It is an insurance program that consists of retirement, disability and survivor benefits. In order to qualify for these benefits most workers pay into the system through social security taxes.

The head offices of the social security agency are located in Woodlawn, Maryland and are referred to as the Central Office. There are tens of thousands of workers employed by the social security agency and it is the largest government program in the United States.

It is estimated that by the end of the 2022 fiscal year the agency will have paid out $1.2 trillion in benefits to 66 million citizens and legal residents of the United States. An additional 61 billion is expected in SSI benefits and 7.5 million to low-income individuals.

This government agency is a vital part of the country's economy and without it millions of already struggling Americans would have nothing. It is a program that many have paid into for decades in preparation for retirement and as an insurance policy against sudden disability.

History of the Social Security Agency

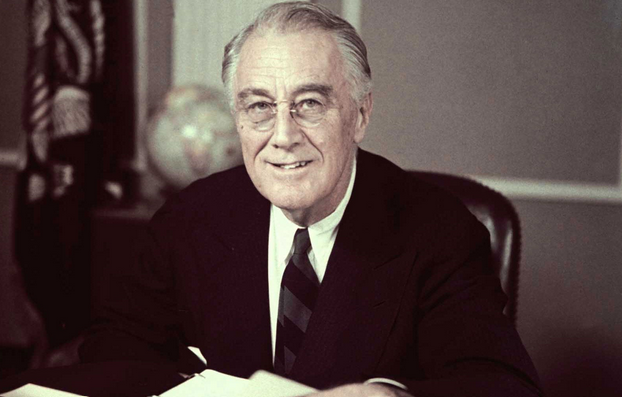

On August 14th 1935, President Franklin D. Roosevelt signed the Social Security Act into law as part of his New Deal initiative. This led to the creation of the Social Security Board (SSB), a presidentially appointed group of three executives tasked with overseeing the social security program.

With zero budget, staff or even furniture the SSB finally obtained funding from the Federal Emergency Relief Administration. It was on October 14th 1936 that the first social security office opened its doors in Austin, Texas.

In January of 1937 social security taxes were first collected. Just a few years later the first social security check was issued to Ida Mary Fuller of Battleboro, Vermont. Ida’s check was dated January 31st 1940 and she received $22.54.

The SSB in 1939 merged with the U.S. Public Health Service, the Civilian Conservation Corp and other government agencies to become the Federal Security Agency. In 1846 under President Harry S. Truman the SSB was named the Social Security Administration SSA.

In 1953 the Federal Security Agency was dismantled and the SSA was placed under the banner of the Department of Health, Education and Welfare. Finally in 1994 President Bill Clinton made the Social Security Administration an independent body once again.

Why Do You Need to Protect Against Social Security Fraud?

There are dishonest people out there who would rather steal from strangers than earn their own money. This is a sad truth and one of the more common ways to do this is by committing social security fraud of some description.

Stealing a person's identity, fraudulently filing taxes in their name to receive a refund that is not due to them or committing fraud against the social security administration itself are just a few ways criminals make money. This is why as responsible individuals we need to take steps to prevent social security fraud of all types.

What to Do if you Suspect Someone of Defrauding the Social Security Administration

Social security fraud is not always against an individual. Sometimes people will fraudulently claim benefits to which they are not entitled. Such fraud uses funds that should be reserved for those who truly need the assistance of social security.

People may claim a disability that prevents them from working and manage to convince the system that they need social security assistance. Many claims are legitimate and this should be noted but some people will defraud the system. There are also those who claim unemployment benefits while working under the table or perpetrating other ways of claiming benefits they are not entitled to.

If you have reason to believe someone you know may be claiming benefits to which they are not entitled you should visit your state's social security administration website to find their contact details relating to fraud. Ensure you can offer as much detail as possible to help assist authorities to investigate the accusations.

How to Prevent Personal Social Security Fraud

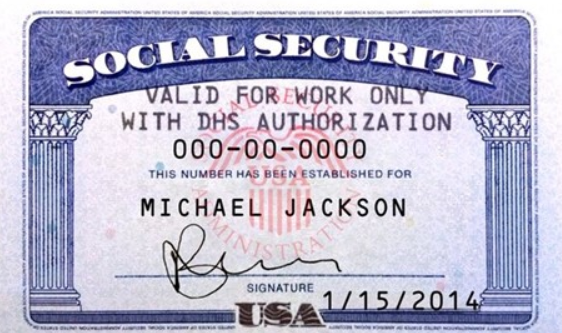

Social security is important to many aspects of our lives from our ability to work, claim needed benefits, obtain financial loans, open credit cards and many more things. Someone gaining information regarding your social security number can do a great deal of damage to your life.

Be careful who you give your social security number to. Always ascertain the reason someone is requiring your social security number, who they will share it with and how it will be protected from abuse.

- Don’t carry your card with you in public: You seldom need your social security card with you on a daily basis. Leave it at home preferably locked in a security box or at least well hidden.

- Shred financial documents before disposal: Throwing away documents that feature financial details without shredding them is a gift to fraudsters. If you need to dispose of old documents, shred them first so they can not be pieced together and used to commit fraud against you.

- Your social security number is not a suitable password: You may be able to remember your social security number and want to use it as a password but don’t. Data breaches are not uncommon and your passwords can be easily exposed if one is your social security number. This is a special gift to criminals.

- Don’t share your social security number in messages: Texting your social security number to someone or sending it by email is highly risky. These methods of communication are rife for being intercepted or read by someone untrustworthy.

- Track your credit report regularly: Use a credit reporting website to keep note of your score and open credit accounts. If something you did not instigate appears, take immediate steps to lock up your social security number.

Final Thoughts

Preventing social security fraud on all levels not only helps protect your interests but also those of other law abiding tax payers in the United States. Be it protecting your own personal data or reporting fraud of the system by others this all goes to support the integrity of a very vital program. We work hard all of our lives so watching criminals and cheats steal money from those who have earned it can be particularly hard to swallow.

Cite This Resource

Use the tool below to generate a reference for this page in common citation styles.

<a href="https://ssalocator.com/blog/how-to-prevent-social-security-fraud.html">How to Prevent Social Security Fraud</a>

"How to Prevent Social Security Fraud." SSA Locator. Accessed January 6, 2026. https://ssalocator.com/blog/how-to-prevent-social-security-fraud.html.

"How to Prevent Social Security Fraud." SSA Locator, https://ssalocator.com/blog/how-to-prevent-social-security-fraud.html. Accessed 6 January, 2026.

How to Prevent Social Security Fraud. SSA Locator. Retrieved from https://ssalocator.com/blog/how-to-prevent-social-security-fraud.html.