Understanding Social Security Benefits for Non-Working Spouses

In this article we are going to take a look at Social Security with a focus on non-working spouses. These are individuals who do not qualify for Social Security benefits on their own merits but may still receive their own assistance from the system.

What Is the Social Security Administration?

The Social Security Administration (SSA) is an independent government agency that administers Social Security. It is an insurance program that consists of retirement, disability and survivor benefits. In order to qualify for these benefits most workers pay into the system through Social Security taxes.

The head offices of the Social Security agency are located in Woodlawn, Maryland and are referred to as the Central Office. There are tens of thousands of workers employed by the Social Security Agency and it is the largest government program in the United States.

It is estimated that by the end of the 2022 fiscal year the agency will have paid out $1.2 trillion in benefits to 66 million citizens and legal residents of the United States. An additional $61 billion is expected in SSI benefits and $7.5 million to low-income individuals.

This government agency is a vital part of the country's economy and without it millions of already struggling Americans would have nothing. It is a program that many have paid into for decades in preparation for retirement and as an insurance policy against sudden disability.

History of the Social Security Agency

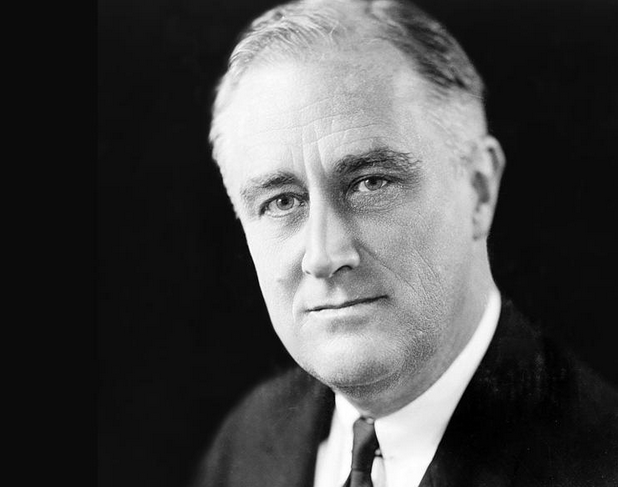

On August 14th 1935, President Franklin D. Roosevelt signed the Social Security Act into law as part of his New Deal initiative. This led to the creation of the Social Security Board (SSB), a presidentially appointed group of three executives tasked with overseeing the social security program.

With zero budget, staff or even furniture the SSB finally obtained funding from the Federal Emergency Relief Administration. It was on October 14th 1936 that the first social security office opened its doors in Austin, Texas.

In January of 1937 Social Security taxes were first collected. Just a few years later the first Social Security check was issued to Ida Mary Fuller of Battleboro, Vermont. Ida’s check was dated January 31st 1940 and she received $22.54.

The SSB in 1939 merged with the U.S. Public Health Service, the Civilian Conservation Corp and other government agencies to become the Federal Security Agency. In 1846 under President Harry S. Truman the SSB was named the Social Security Administration SSA.

In 1953 the Federal Security Agency was dismantled and the SSA was placed under the banner of the Department of Health, Education and Welfare. Finally in 1994 President Bill Clinton made the Social Security Administration an independent body once again.

Benefits for a Non-Working Spouse

A non-working spouse would be someone who likely has not contributed enough into Social Security to qualify for benefits on their own merit. As mentioned this usually occurs from one spouse taking over the role of homemaker and parent while the other earns the revenue used to pay the bills and taxes.

Being married to an individual who is eligible for Social Security means that even as a non-worker the individual may be eligible for retirement benefits when the working spouse reaches at the earliest 62 years of age or receives disability benefits. Additionally the spouse can qualify for Medicare at age 65.

What Is Medicare?

The Medicare program is a national health insurance program that is run by the U.S. government. Originally administered by the Social Security Administration SSA it is today administered by the Centers for Medicare and Medicaid Services (CMS).

It is a program that primarily provides health insurance for individuals over the age of 65. It also covers some younger individuals who suffer from qualifying disabilities. The SSA still makes the determination of qualification. It may include conditions such as amyotrophic lateral sclerosis (ALS) and end stage renal disease as well as certain permanent disabilities.

As already mentioned most Medicare recipients are senior citizens over the age of 65, but millions of Americans also qualify based on specific disability and terminal illnesses. In 2021 the Medicare system cost the U.S. government $696 billion, although after premiums and collections this was actually closer to $875 billion.

It is an expensive program to administer and unfortunately has its enemies in congress who would happily see it torn apart. The result of this would be 64 million Americans with no health insurance in the years that many of them need this coverage the most.

How Much Are Spousal Benefits?

The amount a spouse might receive as a non-working spouse will depend on how much the main taxpayer pays into the system and when they take retirement.

If retirement is taken between age 62 and full retirement the amount for both spouses is permanently reduced by a percentage based on the number of months early that the retirement is taken.

If the spouse is at full retirement age when they retire the non-working spouse receives around half of the amount that their working spouse is entitled to.

Maximizing Spousal Benefits

Generally speaking we make less money during our retirement years so making those benefits stretch further is very important. There are a few strategies that can help you achieve this. There is or I should say was a handy loophole that closed in 2016.

This loophole can still be used if you were born before January 2nd 1954. Essentially when the primary beneficiary reaches the age of 62 which in the case of someone born in 1954 would be 2016 they apply for their Social Security.

Their spouse prior to 2016 could apply for spousal benefits but not actually take their own pension. This allows them to keep accruing Social Security credits until they turn 70 years old. This is when full retirement age is reached and the pension payout is maximized. They would then apply for their full pension which would be the most possible.

Sadly this is not a loophole that can be initiated now as it was closed in 2016. If however the primary beneficiary applied for their Social Security prior to 2016 and you applied for spousal benefits but not a full pension at the same time then some time this year or next year your own pension will be maximized.

These days when you apply for spousal benefits you also apply for your own pension based on your personal work history. You will receive whichever benefit is the highest but can not receive both.

In order to increase your monthly Social Security checks it is advised if you are able to continue working until full retirement age at 70. This will allow you accrue more credits and get the highest pension based on your work history.

Signing up for a My Social Security account with the Social Security Administration will allow you to view your account history. Using this you can get an estimate of your expected retirement benefits. It is also helpful if you want to monitor your Social Security number for fraud.

Divorced Spouse and Social Security Eligibility

Ex-spouses can qualify for spousal benefits based on their former spouses work history. There are some specific rules however that have been set forth by the Social Security Administration. The marriage must have lasted at least 10 full years. As with current spouses the ex-spouse must also be at least 62 years of age to apply.

It is also important that the former spouse has not remarried while the primary beneficiary is still alive. When this happens the Social Security Administration will stop the spousal benefits and the person will have to wait a year before they are eligible for benefits based on their new spouse's work history.

The most important requirement of course when it comes to claiming spousal benefits is that the former spouse is actually eligible for Social Security. If the former spouse did not have enough Social Security credits from their work history they may not be eligible for a pension. As such if they can not claim a pension then their former spouse can not claim spousal benefits based on them.

Some people may qualify for spousal benefits from two different former spouses. Two marriages lasting over 10 years could give this eligibility but can you claim both? Financially it would be great if you could but you only get one spousal benefit.

In the case of people with two former spouses who are primary beneficiaries they would receive the highest of the available spousal benefits. There is no double dipping when it comes to spousal benefits.

If you are eligible for a pension based on your own work history and this is higher than the spousal benefit you will have to claim your own pension and would not claim a spousal benefit.

Applying for Spousal Benefits from an Ex-Spouse

When you are eligible for spousal benefits from an ex-spouse you will need to apply officially. This may require you knowing their Social Security number. You can still apply however if you know their full name, date of birth, place of birth and their parents' information.

You may need proof you were married and occasionally may have to produce the divorce decree. You will of course need your own Social Security number. The process can be done online as SSA.gov, over the phone or in person at a Social Security office.

Final Thoughts

Non-working spouses have often spent their adult life taking care of the family home and any children that come from the marriage. This has likely meant that they did not have their own career and that they themselves were not able to contribute to the Social Security system. Their marriage to a working spouse who has paid into the system however may entitle them to receive benefits based on their contributions.

Cite This Resource

Use the tool below to generate a reference for this page in common citation styles.

<a href="https://ssalocator.com/blog/understanding-social-security-benefits-for-non-working-spouses.html">Understanding Social Security Benefits for Non-Working Spouses</a>

"Understanding Social Security Benefits for Non-Working Spouses." SSA Locator. Accessed January 6, 2026. https://ssalocator.com/blog/understanding-social-security-benefits-for-non-working-spouses.html.

"Understanding Social Security Benefits for Non-Working Spouses." SSA Locator, https://ssalocator.com/blog/understanding-social-security-benefits-for-non-working-spouses.html. Accessed 6 January, 2026.

Understanding Social Security Benefits for Non-Working Spouses. SSA Locator. Retrieved from https://ssalocator.com/blog/understanding-social-security-benefits-for-non-working-spouses.html.