What Happens To Unused Social Security Benefits?

You may have recently lost an elderly family member and be wondering what happens to their monthly Social Security benefits that have gone unused. Perhaps they worked for 50 – 60 years and were only retired for a year or so before they passed away.

It may rightly then be of interest as to where all that accrued Social Security tax will end up if it’s not being paid out to your relative. In this post we will take a closer look at Social Security and what happens to benefits if they go unused.

What Is Social Security?

The Social Security Administration (SSA) is an independent government agency which is part of the U.S. federal government. This agency administers Social Security payments for retirement, disability and survivor benefits.

In order to qualify for these payments workers in the United States contribute to a central fund through Social Security taxes. These taxes are taken from an individual's paychecks based on the person's Social Security number. This nine digit Social Security number uniquely identifies an individual and also authorizes them to hold legal employment in the United States.

Most of the Social Security benefits programs require an individual to have paid into this tax fund or to be the spouse of someone who has. There are however some programs that do not require having paid into the system such as the Supplemental Security Income program.

History of Social Security

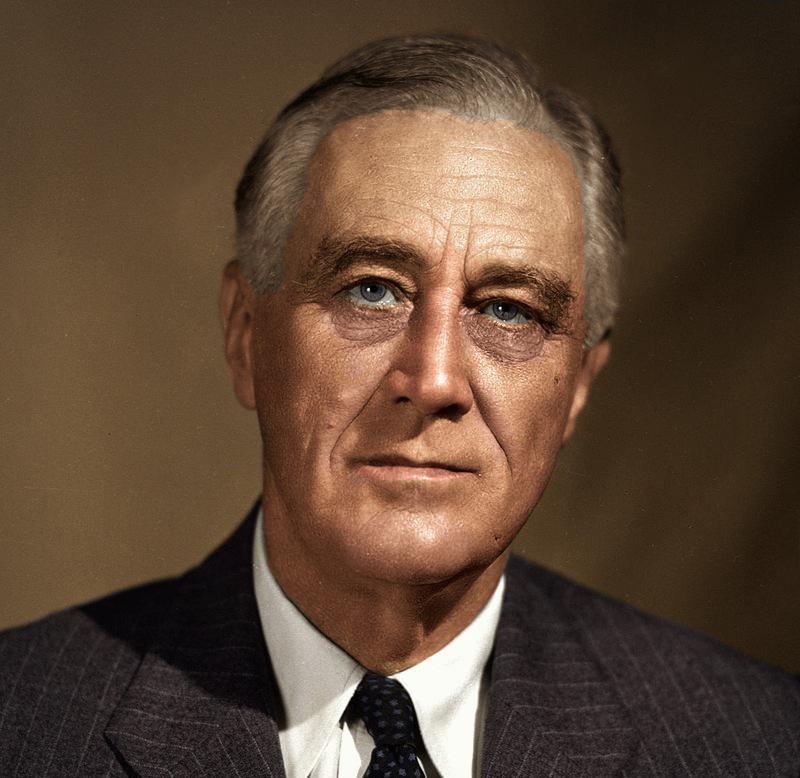

Right in the middle of the Great Depression with millions out of work and living in abject poverty something needed to be done to help American citizens in their time of need. It was between 1933 and 1939 that Franklin D. Roosevelt developed his New Deal, a collection of programs designed to get Americans back to work and prosperity.

A part of this New Deal was the Social Security Act which was signed into law by Roosevelt on August 14th 1935. As mentioned, the basic idea was a tax on income taxes that would go to a mutual fund to supply retirement and disability payments for those no longer able to work.

The first payroll Social Security deductions were collected in January 1937 with the first Social Security check going out in January of 1940. This check dated January 31st 1940 was for $22.54 and was issued to Ida May Fuller of Brattleboro, Vermont.

What Happens to Unused Social Security Benefits?

It is hard to estimate how much 50-60 years of Social Security tax withholdings from one individual might amount to after inflation and interest. If that person however claimed only a few months worth of pension benefits after retirement before dying there would certainly be a lot of unclaimed money left over. What happens to that money?

The simple answer is that that money which has been part of the fund for decades stays exactly where it is. If Social Security benefits are not claimed they remain as part of the central fund and continue toward the benefits of others.

Those Social Security tax dollars are part of a huge trust fund which means the payments made by workers today go to help pay for the pensions of the people who are now retired.

There are some exceptions however as in some cases family members may be entitled to survivor benefits. It wouldn’t technically be a refund of the person's Social Security to a family member rather an extension of the pension payments to a surviving spouse who perhaps did not pay into the Social Security fund through employment taxes.

In the next section we will take a closed look at how Social Security works to hopefully make it clearer as to why unused benefits remain in the fund. We will also highlight some of the programs that have different rules.

Retirement Benefits

As we get older we likely find ourselves not able to work as much as we used to or at all in some cases. This means that without a pension fund they would find themselves with no money for basic expenses. Millions of Americans every year rely on their Social Security monthly checks to make ends meet.

If you receive a regular paycheck you will see those withheld Social Security taxes and with a basic understanding you might think of it as a saving account for retirement. This is not entirely accurate as it is not a personal savings account that is intended solely for your future benefits.

The Old Age Survivors and Disability Insurance (OASDI) tax is a mandatory withholding on any earned income from all Americans. This not only includes W-2 earnings but self-employment. These taxes are all deposited in a single trust fund which is drawn from all American taxed workers.

In order to qualify for retirement benefits the individual must have made sufficient contributions to the Social Security fund. This means they must have at a least a decade of taxed earnings from which OASDI taxes have been taken.

What a person receives from Social Security upon retirement depends on how much they paid in over the years and how many years they have been contributing. Those interested in seeing what their current status is in terms of Social Security can find reports by signing up for a My Social Security account at SSA.gov.

Assuming you have paid sufficiently into the Social Security fund you can retire at the age of 62 and will receive a pension based on your contributions up to that point. You can delay retirement however and work up to age 70 while still accruing Social Security credits.

Accruing additional credits can help you ultimately get a higher monthly pension check. These credits cease to accrue beyond the age of 70 however so this would be the peak of your retirement benefits.

It should be noted that when you reach the age of 65 you will become eligible for Medicare. This is a system of free health care that offers a basic amount of coverage. Those already receiving Social Security benefits at age 65 will automatically be enrolled for Medicare Part A.

Once retirement benefits have started then the individual will continue to receive this monthly payment for the rest of their natural lives. The amount you receive will largely remain the same although changes may occur based on cost of living adjustments.

The payments will be monthly and may not be taken as a lump sum as some private pensions can. This monthly payment will cease upon your death and there should be no check received in the month following your death.

If you die in February then there should be no check for March. Each monthly check is received for the previous month so if you have died during February there is essentially no one to send that check to. If it did get sent to your bank via direct deposit the bank would have to send it back assuming they were informed of your death.

Social Security Disability Insurance Benefits

The other major reason for the creation of Social Security after creating a pension fund for the retired was to also provide for those who through disability cannot earn a living. This was why Social Security Disability Insurance was developed and it comes from the same fund as pensions.

As with pensions to receive this disability insurance you need to have significantly contributed to the Social Security fund through withheld taxes. Ideally we would never need this program but if we were to be disabled to the degree that we could no longer work this would be available.

Supplemental Security Income Benefits

This particular benefit does not come from the Social Security fund so as such does not require Social Security taxes to fund it. Instead a portion of income taxes goes towards a fund that supplies the money for this program.

Supplemental Security Income benefits are for disabled adults, disabled children and people over 65 years old who have low incomes. They have likely never been able to pay into the Social Security system so do not have the benefit of those programs.

The Social Security Administration does administer this benefit but the money for the benefits does not come from their own funds. As the individuals often do not contribute to the fund through taxes there really are no “unused” funds involved in this case.

Who Is Eligible for Social Security Benefits?

As mentioned, to be eligible for benefits from the Social Security fund you generally need to have been paying Social Security taxes for at least 10 years. With regards to retirement taxes you have to be 62 years old or above and your accrued credits max out at age 70.

Disability benefits through Social Security also require a minimum amount of taxable income into the fund, usually at least 5 years. The disability also must have or be expected to last over 12 months or result in death. The disability or illness must also make it impossible for you to perform a job.

If you could get some form of gainful employment but could not perform your previous job you would not be eligible. This is because a change of profession would allow you to continue earning your own income.

Benefits Through a Spouse

You may receive Social Security benefits if you had a spouse who contributed to the Social Security funds through their work life. You might qualify for spousal benefits or even survivors benefits if the primary beneficiary has accrued enough credits.

These spousal benefits can start as early as 62 years old and may supply up to 50% of the spouse pension value to you. It is also possible to get spousal benefits from an ex spouse if the marriage lasted at least 1 year and you can not have remarried.

When Do Social Security Benefits End?

Generally speaking with the exception of survivors benefits all Social Security benefits end when the individual dies. If a survivor's benefit is in effect then the beneficiary will receive this until their own death but it can not be passed on beyond that.

When it comes to disability benefits these will end when and if the disability ends or the individual dies. There may be a requirement to reconfirm that a disability is still keeping you from gainful employment. If a person recovers from a disability and fails to notify Social Security they may be in violation of federal law and can be convicted.

If a disability lasts into retirement age the individual may find retirement benefits pay more than disability so can instead switch to a pension over disability benefits.

Who Qualifies for Survivor Benefits?

Survivor benefits are also known as Widow or Widower Benefits as they relate to the surviving spouse of a Social Security beneficiary. The spouse must be 60 years or older to claim retiree benefits and 50 years or older for disability benefits.

A surviving spouse can receive up to 100% of their deceased spouse's pension and will be eligible to receive it at any age if they are also supporting the minor child of the deceased. This also extends to divorced individuals as long as the claimant has not remarried.

A widow and an unmarried ex of an individual claiming Social Security benefits would both be eligible for survivor benefits and would not have to split the payment.

Conclusion

The answer to the question of what happens to unused Social Security benefits is quite simple. If there is no surviving family member who is eligible for survivor benefits then the remaining benefits remain in the Social Security fund.

Social Security is not a private pension fund so can not be paid out in a lump sum and usually ceases when the beneficiary dies. The money is collected from every American taxpayer and enters a single fund from which benefit payments are drawn.

Reference SSA Locator

If you use any of the forms, definitions, or data shown on SSA Locator, please make sure to link or reference us using the tool below. Thanks!

-

<a href="https://ssalocator.com/blog/what-happens-to-unused-social-security-benefits/"> What Happens To Unused Social Security Benefits?</a>

-

" What Happens To Unused Social Security Benefits?". SSA Locator. Accessed on June 30, 2025. https://ssalocator.com/blog/what-happens-to-unused-social-security-benefits/.

-

" What Happens To Unused Social Security Benefits?". SSA Locator, https://ssalocator.com/blog/what-happens-to-unused-social-security-benefits/. Accessed 30 June, 2025

-

What Happens To Unused Social Security Benefits?. SSA Locator. Retrieved from https://ssalocator.com/blog/what-happens-to-unused-social-security-benefits/.