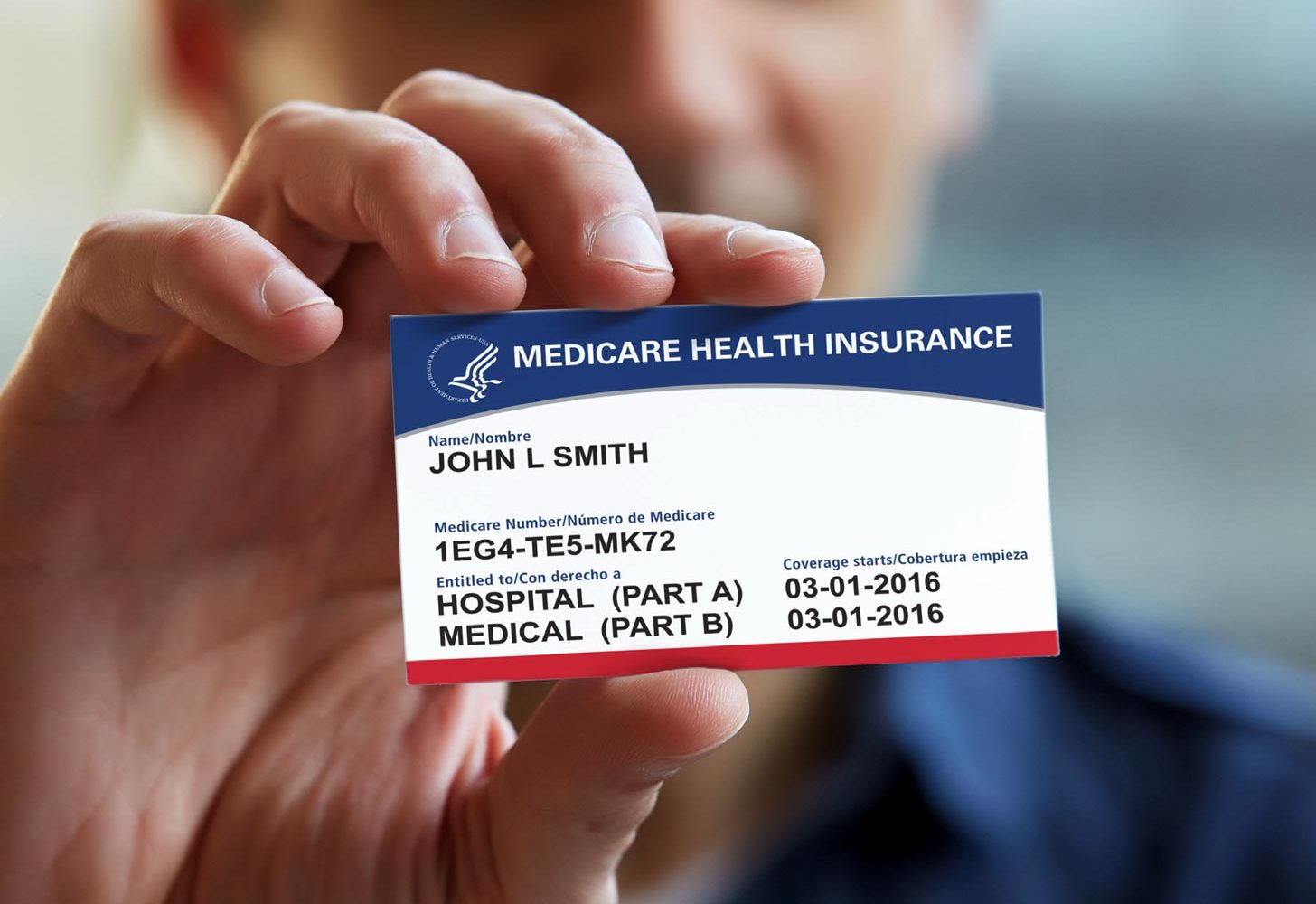

What is a Medicare Flex Card?

According to the Centers for Medicare and Medicaid Services, as of October 2021 there were almost 64 million Americans enrolled in the Medicare program. This is a substantial portion of the adult population of the United States.

It is an important tool for senior Americans as well as certain qualifying non seniors with disabilities. As such the benefits attached to it are important. In this post we will be looking more closely at Medicare and specifically at the Medicare Flex card.

What Is Medicare?

The Medicare program is a national health insurance program run by the U.S. government. It was originally administered by the Social Security Administration SSA but is today headed up by the Centers for Medicare and Medicaid Services (CMS).

This program provides health insurance for individuals who are over 65 years of age but it also covers some younger individuals with qualifying disabilities. The determination of qualification for early Medicare comes from the SSA. It may include conditions such as amyotrophic lateral sclerosis (ALS) and end stage renal disease as well as certain permanent disabilities.

As already mentioned the vast majority of Medicare recipients are senior citizens over the age of 65, but millions of Americans also qualify based on specific disability and terminal illnesses. In 2021 the Medicare system cost the U.S. government $696 billion, although after premiums and collections this was actually closer to $875 billion.

It is not an expensive program to administer and unfortunately has its enemies in congress who would happily see it torn apart. The result of this would be 64 million Americans with no health insurance in the years that many of them need this coverage the most.

History of Medicare

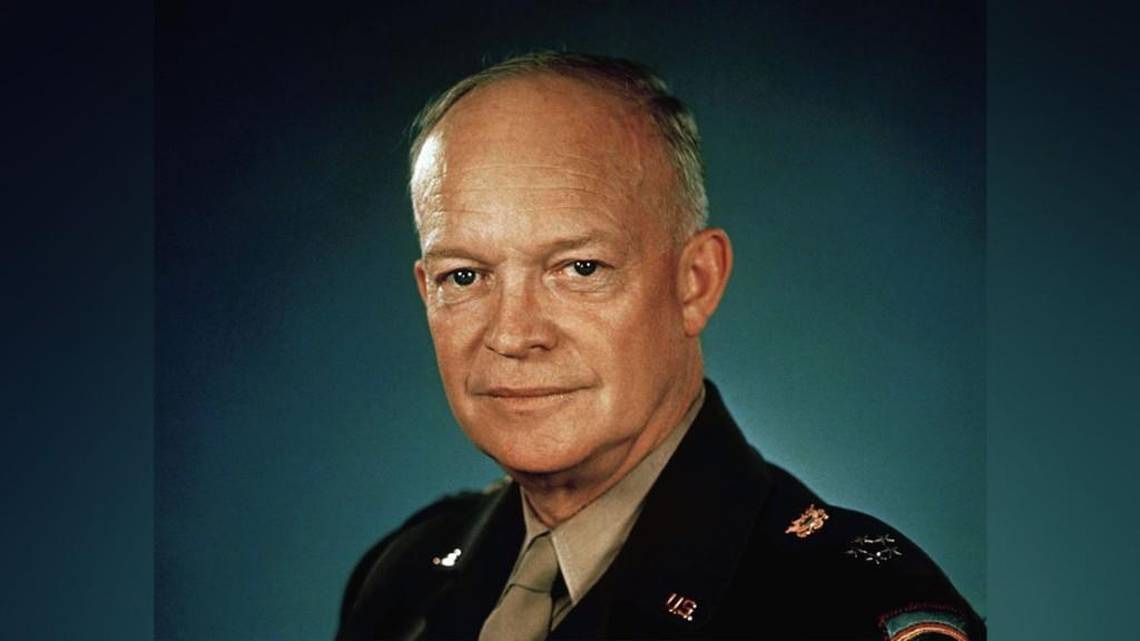

Medicare as a term was first used in the United States to refer to medical care for the families and dependents of military personnel. This was part of the 1956 Medical Care Act signed by President Dwight D. Eisenhower. A few years later in 1961 President Eisenhower held a conference in the White House on aging. It was suggested during this conference that a health care program was needed for Social Security beneficiaries.

Just four years later in July of 1965 President Lyndon Johnson signed the Title XVIII amendment of the Social Security Act that would provide health insurance to people over the age of 65.

The Social Security Amendments act was signed on July 30th 1965 at the Harry S. Truman presidential Library. The former president Truman and his wife Bess became the first recipients of the program. Prior to this program only about 60% of individuals over 65% had health insurance in the United States.

In 1966 the program did its part in fighting racial segregation. The act specified that payments from the system would only be made to health care providers who desegregated their waiting rooms. Until this point health care providers in some regions had separate waiting rooms for white and African American patients.

Over the years the program has expanded to cover more and more aspects of health care. It also started to offer free health insurance to those with qualifying disabilities and certain degenerative conditions.

What Is a Medicare Flex Card?

The Medicare flex card is essentially a prepaid debit card that is tied to a flexible spending account (FSA), health savings account (HSA) or a health care reimbursement account (HRA) You have heard of those three acronyms while applying for medical insurance in the past so already have an idea how this works.

These cards are pre-loaded with a certain amount of money that can be used for an array of medical expenses. In most cases these cards are reloaded annually as long as you maintain your insurance plans. They are as easy to use as a debit or credit card.

After a visit to your health care provider or a pharmacy you need only swipe the flex card to pay for the services you received. This might include copays, prescriptions and over the counter medications as well as many other services.

The most important thing to know about Medicare flex cards is that they are not an official part of the Medicare program and are not issued as part of Medicare. You may see some cards claiming to come from Medicare but no such cards exist and these would likely be scams.

Flex cards are issued by the private insurance companies that offer Medicare Advantage or Part C plans. This means you must have a Medicare Advantage plan to qualify for one of these cards.

How Much Is Loaded on the Flex Card?

The amount of money that gets loaded to the flex card is dependent on the health care plan you have. On average the amount will be around $500 and you should easily be able to track the card's balance online through your provider.

Cards that claim to load up to $3,000 would be extremely unlikely on Medicare so any claiming this may be fraudulent. Generally speaking $1,000 per year on one of these types of cards for Medicare is the very top end.

How to Use a Medicare Flex Card

As mentioned, flex cards are as easy a method of payment for health care needs as a debit or credit card. You only need to present your provider with the card and they can swipe this as you would any other payment card.

Depending on your insurance provider it will either be a Mastercard or a Visa but whichever it is it still works in the same fashion. They do not have PIN codes for protection so they will have to be scanned as credit cards rather than debits.

The transaction should go through fine as long as you have enough funds loaded onto the card. If you do not have enough on the card it will likely be declined so keep a close eye on your balance before using it for purchases or payments.

Once the card is accepted you will have to sign a receipt as it is a credit type payment. It should also be noted that as the IRS has specific definitions of what constitutes medical expenses these cards can only be used for certain things.

If you pay for something that is not covered on the card you may have to pay back the amount spent onto the card. The IRS can also hit you with tax penalties for misusing the card so it is vital to know what you can use this card for.

It is advised you keep all receipts from the medical expenses paid for with the card in case there are later tax issues. You may need to produce these receipts later to justify the expenses.

How Do You Qualify for a Medicare Flex Card?

As mentioned the flex cards are not a government issued part of your Medicare benefits they are specifically issued by the insurance providers. They are essentially a perk to entice you to buy their Medicare Advantage plans over those of their competitors.

In order to qualify for a Medicare flex card you must first be enrolled in a Medicare Advantage or Part C insurance plan. It is only Medicare Advantage plans that offer this card service so a Part A or B would not qualify.

Not all Medicare Advantage plans offer this card service so you may have to shop around to find one that does. Most of the top insurance providers however do offer these flex cards as an option so there should be no issue finding one.

In terms of personal eligibility you must be eligible for Original Medicare which likely means you are over the age of 65. If you have been a recipient of Social Security Disability Insurance benefits for more than two years you would be eligible for Medicare and therefore also the flex card where available.

You need only upgrade to a Medicare Advantage plan that offers the card as a perk to qualify for the program. If you need to locate a participating plan you should visit Medicare.gov to search for a company in your area that offers this service.

What Do Medicare Flex Cards Pay For?

Essentially Medicare flex cards can be used anywhere although the purchases must be medically necessary. You can for instance purchase groceries if a specific diet is required. The card however should not be used to get snacks for a Super Bowl party.

No qualifying purchases can lead to a request for proof of them being necessary. If the purchase is deemed to have been not medically required you will have to repay the funds and may be penalized on your taxes.

Simply put, there is no benefit whatsoever to using this for non medical expense purposes. Below then is a list of valid uses for the flex card.

- Coinsurance amounts

- Copays

- Deductibles

- Prescription meds

- Medical equipment

- Over the counter meds

- Glasses

- Eye exams

- Contact lenses

- First aid supplies

- Dental care

- Diagnostic devices

- Medically necessary expenses

As mentioned you will need to keep all receipts from using this card as you may be required to defend your purchases. Only medically needed services or products are covered by these cards so orthopedic shoes may be covered but Air Jordans will not.

This card if not used correctly could cause you issues so only use it as instructed. It is not an extra credit card in your wallet to help you get by. Using it for anything but qualifying services can lead to tax penalties.

Conclusion

The Medicare flex card is very easy to use and in theory you can buy almost anything with it. However Just because you can use it almost anywhere does not mean you should as only certain things should be bought with this pre-loaded card.

Using the funds on this card for non medical costs can get you in a great deal of trouble so do not mistake this as a prepaid credit card. If you feel overwhelmed by the prospect of potentially having to account for purchases on this card it may not be the thing for you.

It is certainly a handy card to help cover certain medical costs such as co-pays and medications but abuse is not tolerated. This is not an official card issued by the Social Security Administration, it is a sales tool to get you to choose a specific Medicare Advantage plan.

This then is why it can be problematic so you should do your research to determine if this is a perk that you really need.

Cite This Resource

Use the tool below to generate a reference for this page in common citation styles.

<a href="https://ssalocator.com/blog/what-is-a-medicare-flex-card.html"> What is a Medicare Flex Card?</a>

" What is a Medicare Flex Card?." SSA Locator. Accessed January 6, 2026. https://ssalocator.com/blog/what-is-a-medicare-flex-card.html.

" What is a Medicare Flex Card?." SSA Locator, https://ssalocator.com/blog/what-is-a-medicare-flex-card.html. Accessed 6 January, 2026.

What is a Medicare Flex Card?. SSA Locator. Retrieved from https://ssalocator.com/blog/what-is-a-medicare-flex-card.html.