What is Medicare Part B Give Back Benefit?

According to the Centers for Medicare and Medicaid Services, as of October 2021 there were almost 64 million Americans enrolled in the Medicare program. This is a little over 1/5 of the country's population who rely on this vital medical resource.

It is an important tool for senior Americans as well as certain qualifying non-seniors with disabilities. As such the benefits attached to it are important. In this post we will be looking more closely at Medicare and specifically at the Part B Give Back benefit.

What Is Medicare?

The Medicare program is a national health insurance program supplied by the U.S. government. Originally administered by the Social Security Administration SSA it is today controlled by the Centers for Medicare and Medicaid Services (CMS).

It primarily provides health insurance for individuals over 65 years of age but can also cover younger individuals with qualifying disabilities. The determination on qualifying for early Medicare comes from the SSA and may include conditions such as amyotrophic lateral sclerosis (ALS) and end stage renal disease.

As mentioned the vast majority of Medicare recipients are seniors over the age of 65 but millions of Americans qualify based on disability and terminal illnesses. In 2021 Medicare cost the U.S. government $696 billion although after premiums and collections this was actually closer to $875 billion.

It is not a cheap program to administer and it has its enemies in congress who would happily see it torn apart. This would of course leave 64 million Americans with no health insurance in the years that many of them need this coverage the most.

History of Medicare

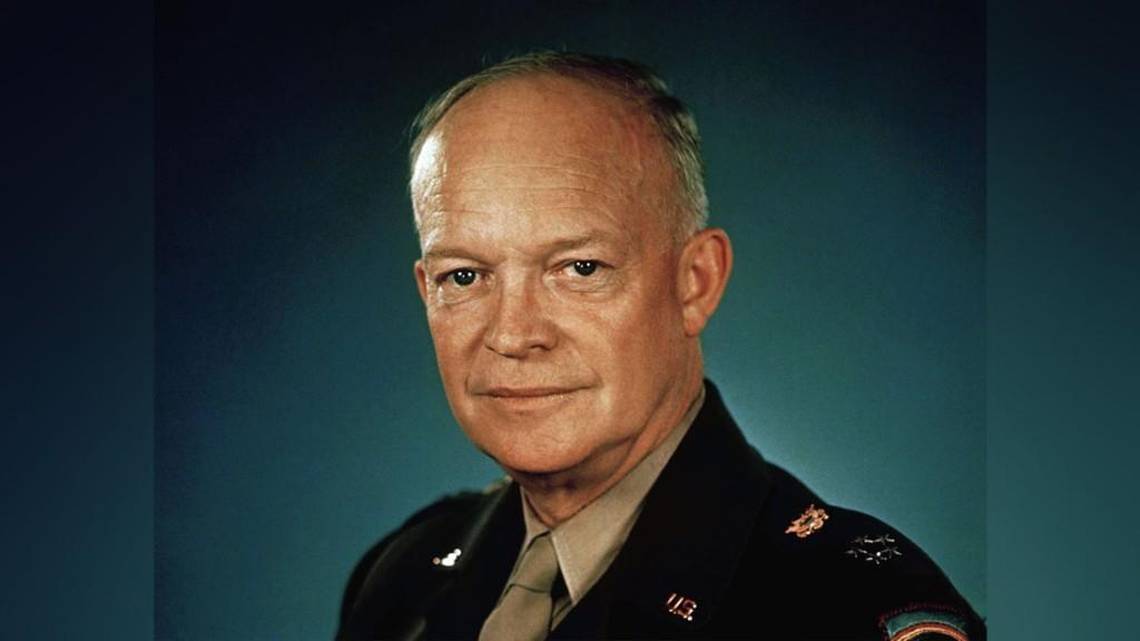

The term Medicare was used in the United States firstly to refer to medical care for the families of military personnel. This was part of the 1956 Medical Care Act signed by President Dwight D. Eisenhower. In 1961 Eisenhower held a conference in the White House on aging in which it was suggested that a health care program was needed for Social Security beneficiaries.

It was four years later in July of 1965 that President Lyndon Johnson signed the Title XVIII amendment of the Social Security Act that would provide health insurance to people over the age of 65.

The Social Security Amendments Act was signed on July 30th 1965 at the Harry S. Truman presidential Library. The former president Truman and his wife Bess became the first recipients of the program. Prior to this program only about 60% of individuals over 65% had health insurance in the United States.

In 1966 the program did its part in fighting racial segregation. The act specified that payments from the system would only be made to health care providers who desegregated their waiting rooms. Until this point health care providers in some regions had separate waiting rooms for white and African American patients.

Over the years the program has expanded to cover more and more aspects of health care. It also started to offer free health insurance to those with qualifying disabilities and certain degenerative conditions.

What Is Medicare Part B?

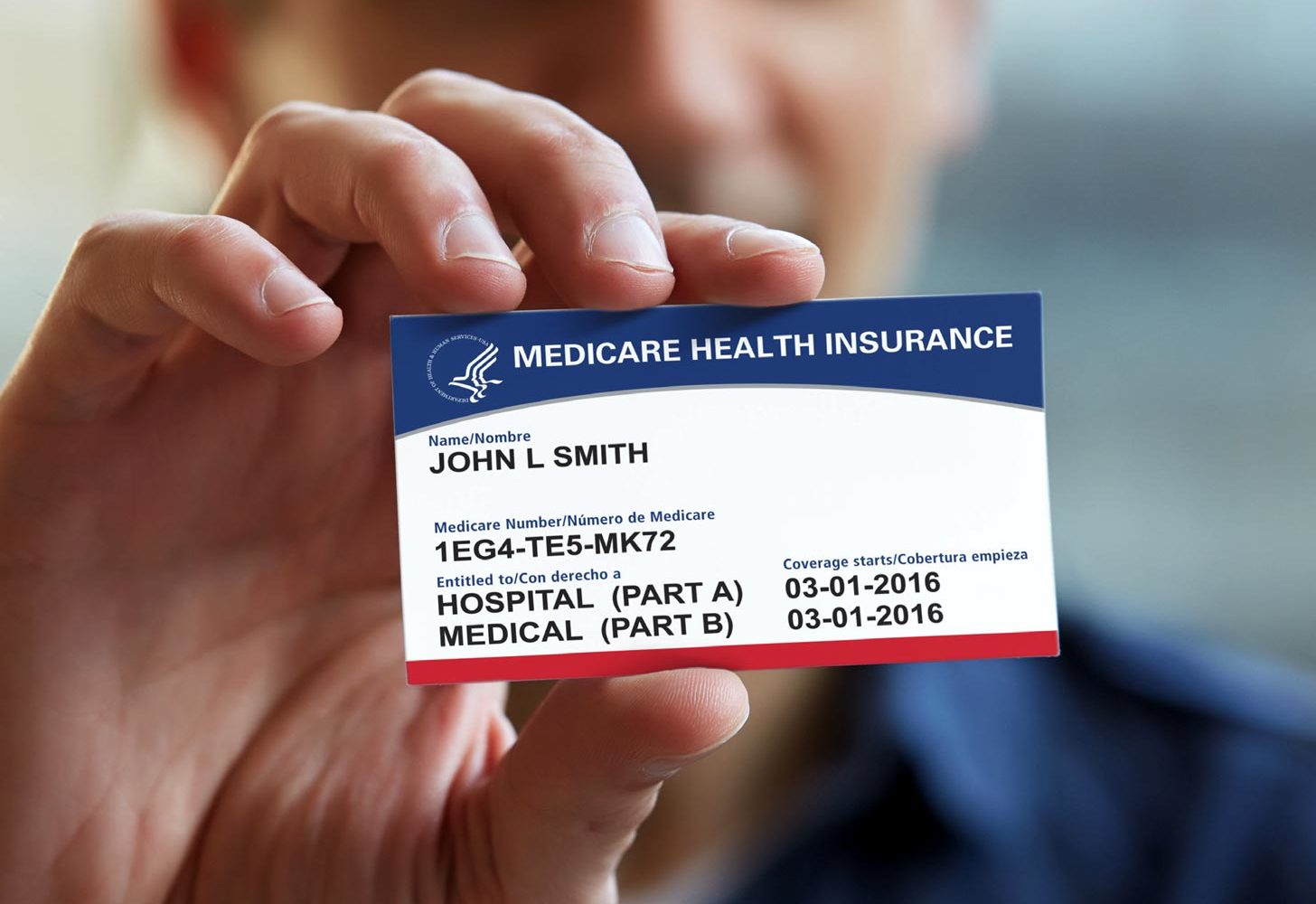

It is important to note that Medicare is actually broken down and comes in four levels each of which covers specific aspects of health insurance. The Basic level is free although Parts B, C and D all cost extra.

- Part A covering hospital admissions, skilled nursing and hospice services

- Part B covers outpatient services such as provider office visits and drug administration

- Part C is Medicare Advantage that allows patients to to choose a plan that offers at least basic Medicare coverage but can also be added to by the payment of an out of pocket premium

- Part D covers mostly self-administered prescription drugs.

The part B aspect of Medicare can help pay for outpatient services and is actually optional. This is sometimes deferred if the primary beneficiary is still working and has group health care through an employer.

There is a 10% penalty per year however for not enrolling in Part B when first eligible. When chosen this coverage kicks in once the patient meets their deductible. Once reached Medicare will cover around 80% of the costs.

It covers 100% of the cost for preventative services including age related screenings for certain conditions. It also covers costs for vaccinations, blood transfusions, chemotherapy and a host of other medical needs. Certain equipment such as walkers, canes, and wheelchairs are also covered by Part B insurance.

What Is The Medicare Part B Give Back Benefit?

The Medicare Part B Give Back benefit is offered to some Medicare Advantage insurance policy holders that can assist with the premiums for part B. This is not an official Medicare benefit however as it is not part of the program itself.

Those eligible for the Give Back benefit must be Part C Medicare insurance holders. This option is usually offered as an enticement to pay the additional premiums for the higher Medicare level. Also known as the Part B premium reduction it essentially decreases Part B costs to make Part C more affordable.

If you sign up for a Part C or Medicare Advantage plan which includes Part B Give Back then the carrier will pay a part of your Plan B premium. In some instances the insurance carrier may even pay the entire Part B premium.

Those who were thinking they would receive some form of rebate in the form of a check may be a little disappointed to hear that it is a discount rather than a give back. So the give back is essentially deducted from your monthly premium cost.

Generally speaking most people have their Medicare premiums deducted from their Social Security checks each month. As a result opting for a Part C plan with offers Part B Give back will see less money deducted from your check.

A Little Warning

It should be noted that the Part B Give Back benefit is not a government affiliated program. This means that there may be a few drawbacks to taking such a plan. The companies that set these plans do get to set some of their own rules.

The insurance providers must provide at least the minimal level of coverage provided by Original Medicare. Beyond this they can set their own rules with regards premiums, copays, coinsurance and deductibles.

As a result taking a Part B Give Back might mean certain other things are not covered. As an example dental or vision coverage may not be included requiring an additional premium. They may also charge a higher premium for the Part C to recoup the money spent on the Part B Give Back.

Essentially you may get a discount or be charged no cost on your Part B Medicare but this may be recouped with higher premiums or copays. The intent is to entice you into purchasing the higher premium Part C plan by making you think it will be cheaper. Overall however it may cost you more than you save by getting this Part B Give Back discount.

Therefore you should study the plans in detail to make sure that this offer will actually save you money. It does no good to save a few hundred dollars a year on a Part B plan through giveback if your overall costs go up by thousands.

Who Is Eligible for Part B Give Back Benefits?

It is not too difficult to qualify for a Part B Give Back benefit but there are some definite requirements. You must of course be eligible for and enrolled in Original Medicare. Parts A and B are necessary to make you eligible for the Give Back benefit.

You must pay for your own Part B premiums each month without any financial assistance from another program. If Medicare assists you with your Part B premium then you would not be eligible for a Give Back program.

The final requirement is geographical in that you must live in a service area that offers Give Back programs. At present 48 states have health insurance providers that offer a Part B Give Back program. It is therefore wise to check that you live in a covered region by doing a ZIP code search for available Medicare Advantage plans.

How to Apply for a Medicare Part B Give Back Benefit

As mentioned this type of benefit is not affiliated with government funded healthcare so it is more a consumer based process. Firstly you will need to find the Medicare Advantage plan that best suits your needs and also includes Part B Give Back.

A good way to find the best plan might be to search medicare.gov for Medicare Advantage plans in your area. You might also contact a licensed insurance agent who could help you to find the best plan for your needs.

Having found the plan you want and having reviewed it to make sure that you will indeed save money in the long run you simply need to make the purchase as you normally would. As long as you pay for your own Part A & B insurance you should be eligible for this Give back if offered by your provider.

Conclusion

The Part B Give Back benefit is not a government program so as such is not available on all Medicare plans. It is an insurance provider sales tool that is only available by signing up to a participating insurance company.

It may save you money on your Part B Medicare insurance premiums but you will not receive a check. The benefit comes in the form of paying partially or completely the cost of your Part B monthly premium.

It should be noted that receiving this discount may mean a decrease in your available health care services or a higher Part C insurance premium. This can mean you might not save any money with a Give Back benefit.

Make sure to fully understand insurance coverage and associated costs to make sure you will not end up more out of pocket for this discount to your Part B premium. As I say it’s an enticement to buy rather than a government benefit so “buyer beware.”

Reference SSA Locator

If you use any of the forms, definitions, or data shown on SSA Locator, please make sure to link or reference us using the tool below. Thanks!

-

<a href="https://ssalocator.com/blog/what-is-medicare-part-b-give-back-benefit/"> What is Medicare Part B Give Back Benefit?</a>

-

" What is Medicare Part B Give Back Benefit?". SSA Locator. Accessed on July 5, 2025. https://ssalocator.com/blog/what-is-medicare-part-b-give-back-benefit/.

-

" What is Medicare Part B Give Back Benefit?". SSA Locator, https://ssalocator.com/blog/what-is-medicare-part-b-give-back-benefit/. Accessed 5 July, 2025

-

What is Medicare Part B Give Back Benefit?. SSA Locator. Retrieved from https://ssalocator.com/blog/what-is-medicare-part-b-give-back-benefit/.