What Is OASDI Tax?

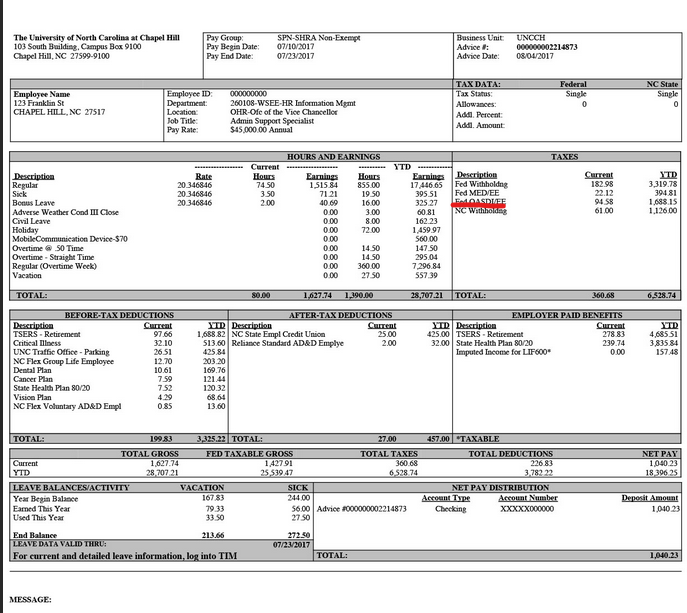

Most of us have likely seen a pay stub at some time or other and seen the amount we made compared to what we actually received. It’s probably not our favorite thing in the world to see but the difference in the two totals is outlined in specific tax withholdings.

You will likely see an amount for federal tax, state tax, Medicare and also possibly OASDI tax. On some paystubs this may go by a different name but we will get into that later. In this post we are going to look at OASDI taxes and explain them in more detail.

What Is OASDI Tax?

So what does the abbreviation OASDI stand for? Simply put it stands for “old age, survivors and disability insurance.” This is otherwise known as Social Security tax and is withheld from the wages from all American wage earners.

This is an automatic tax that is withheld from your wages and if you have an employer they will match your contributions. Self employed individuals will have to declare their own earnings at the end of the tax year and contribute based on their taxable earnings.

The money from OASDI taxes goes into a central fund that is used to pay out pensions to retirees and fund several other benefits programs including Social Security Disability Insurance (SSDI). It is the most expensive program in the U.S. government's annual budget.

This program ensures that qualified individuals have an income when they can no longer work based on old age, death of a spouse and/or disability. Around 85% of the tax amount collected is used to fund retirement pensions and survivor benefits. The remaining 15% is used for SSDI benefits for those unable to work due to their disabilities.

A small fraction of 1% of each dollar collected actually goes to fund, the overheads and administration of the program. This self-sufficiency in the program means that even during a full government shutdown which has happened 11 times as of August 2022, it can still function.

Benefit checks and payments will still be sent out to those who need them even when the government itself is essentially shut down. Services are decreased however so new applications can get delayed.

The OASDI is a 100% mandatory tax which all American taxpayers must pay. If you wish to earn money in the United States you have to file annual tax returns and pay the assessed taxes. Some jobs will automatically deduct taxes from your paychecks. Those who are self-employed have to declare their earnings and pay the taxes at the end of the year.

It is the Federal Insurance Contributions Act that led to the creation of these many types of taxes including OASDI. Without this payroll tax the Social Security system would collapse and millions of Americans would be left with no source of income and no ability to find gainful employment.

History of Social Security

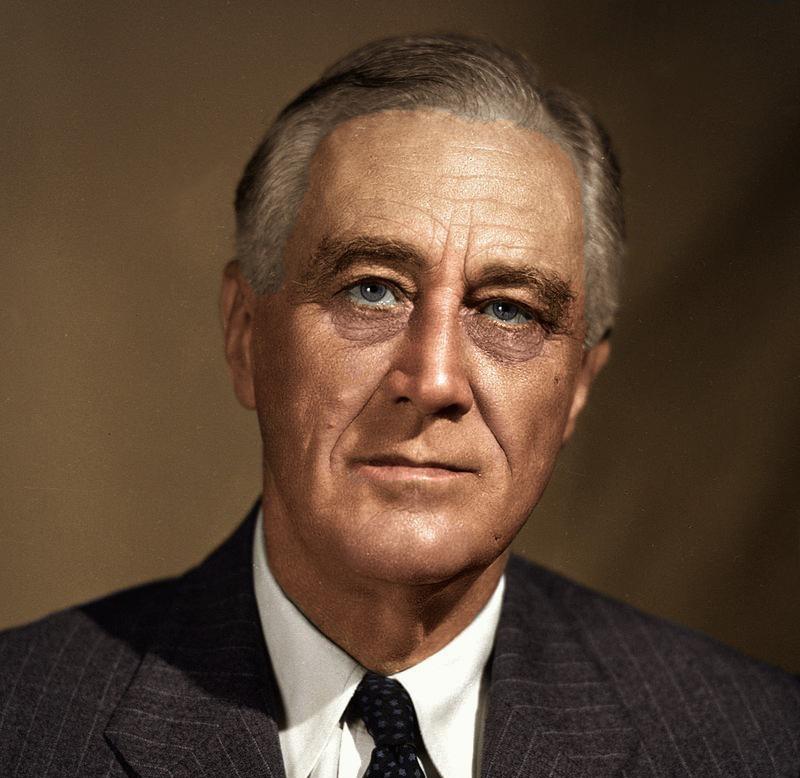

Right in the middle of the Great Depression with millions out of work and living in abject poverty something needed to be done to help American citizens in their time of need. It was between 1933 and 1939 that Franklin D. Roosevelt developed his New Deal, a collection of programs designed to get Americans back to work and prosperity.

A part of this New Deal was the Social Security Act which was signed into law by Roosevelt on August 14th 1935. As mentioned, the basic idea was a tax on income taxes that would go to a mutual fund to supply retirement and disability payments for those no longer able to work.

The first payroll Social Security deductions were collected in January 1937 with the first Social Security check going out in January of 1940. This check dated January 31st 1940 was for $22.54 and was issued to Ida May Fuller of Brattleboro, Vermont.

What Does OASDI Tax Get You?

With OASDI or Social Security taxes being mandatory you might be wondering what it gets you. You might be in your early 20s making decent money and loving life. Why would you need to be losing some of your income each paycheck with no visible return on the deal.

I’ve been in my 20s. I lived the fun life: earn, party, sleep, repeat. You don’t think about what happens forty, fifty years down the line. Well Social Security does and these OASDI taxes which may seem annoying today may be vital in your later years.

To be eligible to receive Social Security benefits you have to have paid at least a minimum amount into OASDI taxes. Generally speaking you will need to have been contributing into the Social Security system for at least 10 years.

Those who may find themselves needing disability benefits from Social Security will usually need at least 5 years of contributions to qualify. Essentially speaking OASDI taxes are your insurance to cover the times in your life where you can no longer work.

Social Security may also provide for your spouse and young children after your death in the form of Survivor benefits. This system was a response to the poverty of the Great Depression and is intended to help avoid such a human tragedy again.

There is always the temptation to work under the table as it were to avoid paying pesky taxes. This however could turn out to be a big mistake. Aside from the obvious illegality of this practice and the potential punishments you are neglecting your future financial stability.

You could spend 40 years working a job and dodging taxes and then your body starts to fail. The job may have become too taxing or an injury leaves you unable to work. You never paid any Social Security taxes and your employer no longer has use for you and has already hired a much younger replacement.

There is no safety net for you financially as you are not eligible for Social Security. There are government programs that do not need a history of Social Security contributions. The trouble is what do you say when they ask what you have been doing for 40 years?

The idea of not paying taxes is appealing and some days you look at how politicians are and wonder what the heck we are paying for but some taxes really are in our best interests.

How Much of Your Income Goes to OASDI?

Out of each of your paychecks a certain percentage is withheld to go into the Social Security system by way of the OASDI tax. This percentage is 6.2% which essentially equates to $6.20 from each $100 you earn.

If you have your taxes withheld by your employer they also contribute an amount equal to 6.2% of your earnings. The employer uses these taxes as a deduction in their own end of year taxes. If you are self employed you have to pay both the employee and employee portions of the tax so will be paying 12.4% of your income into Social Security.

There is an annual cap on OASDI taxable income which as of 2022 stands at $147,000. If you were to reach this amount in OASDI taxable income you will not need to pay further Social Security taxes until the next tax year. Therefore the maximum OASDI taxes you will pay in 2022 is $9114. This cap amount usually increases annually however so next year's maximum may be a little higher.

If you work two jobs they keep their own individual tally of your Social Security taxable income so if your combined income reaches the cap the jobs will still deduct OASDI taxes. You can reclaim these additional payments at the end of the year when you file your Federal tax return.

Is The Social Security System in Danger?

You may have heard murmurings that Social Security is at risk and this is likely true. It is estimated that the current system may collapse in about 30 years. This is the reason that President Biden during his campaign was suggesting an increase in the OASDI cap.

The intent is to increase this cap to recoup extra Social Security withholdings up to a limit of $400,000 of taxable income. This would mean a maximum tax of $24,800 a year for Social Security payments. Obviously there is a lot of opposition to this as higher earners will be paying more taxes.

This change would not affect individuals who make under $147,000 as they will never reach the new cap. It mainly focuses on those making between $147,000 and $400,000.

As a system the Social Security System has always had an enemy in the form of the Republican party ever since its inception in 1935. Roosevelt was a Democrat and he faced serious opposition from Republicans who to this day still work hard to end this benefits system. For the sake of seniors and the disabled lets hope this never happens.

Conclusion

Old age, survivors and disability insurance (OASDI) tax is the mandatory withholding that all American taxpayers must pay. It equates to about 6.2% of the income of W2 employees and 12.4% for self employed individuals.

The money from this tax goes to fund and administer the Social Security system, a vital lifeline for seniors and the disabled. These taxes are required to secure retirement benefits for American workers in their later years.

Reference SSA Locator

If you use any of the forms, definitions, or data shown on SSA Locator, please make sure to link or reference us using the tool below. Thanks!

-

<a href="https://ssalocator.com/blog/what-is-oasdi-tax/"> What Is OASDI Tax?</a>

-

" What Is OASDI Tax?". SSA Locator. Accessed on July 6, 2025. https://ssalocator.com/blog/what-is-oasdi-tax/.

-

" What Is OASDI Tax?". SSA Locator, https://ssalocator.com/blog/what-is-oasdi-tax/. Accessed 6 July, 2025

-

What Is OASDI Tax?. SSA Locator. Retrieved from https://ssalocator.com/blog/what-is-oasdi-tax/.