The Complete Guide to Social Security Payments

What Is the Social Security Administration?

The Social Security Administration (SSA) is an independent government agency that administers Social Security. It is an insurance program that consists of retirement, disability and survivor benefits. In order to qualify for these benefits most workers pay into the system through Social Security taxes.

The head offices of the Social Security Agency are located in Woodlawn, Maryland and are referred to as the Central Office. There are tens of thousands of workers employed by the Social Security Agency and it is the largest government program in the United States.

It is estimated that by the end of the 2022 fiscal year the agency will have paid out $1.2 trillion in benefits to 66 million citizens and legal residents of the United States. An additional $61 billion is expected in SSI benefits and $7.5 million to low-income individuals.

This government agency is a vital part of the country's economy and without it millions of already struggling Americans would have nothing. It is a program that many have paid into for decades in preparation for retirement and as an insurance policy against sudden disability.

History of the Social Security Agency

On August 14th 1935, President Franklin D. Roosevelt signed the Social Security Act into law as part of his New Deal initiative. This led to the creation of the Social Security Board (SSB), a presidentially appointed group of three executives tasked with overseeing the Social Security Program.

With zero budget, staff or even furniture the SSB finally obtained funding from the Federal Emergency Relief Administration. It was on October 14th 1936 that the first Social Security Office opened its doors in Austin, Texas.

In January of 1937 Social Security taxes were first collected. Just a few years later the first Social Security check was issued to Ida Mary Fuller of Battleboro, Vermont. Ida’s check was dated January 31st 1940 and she received $22.54.

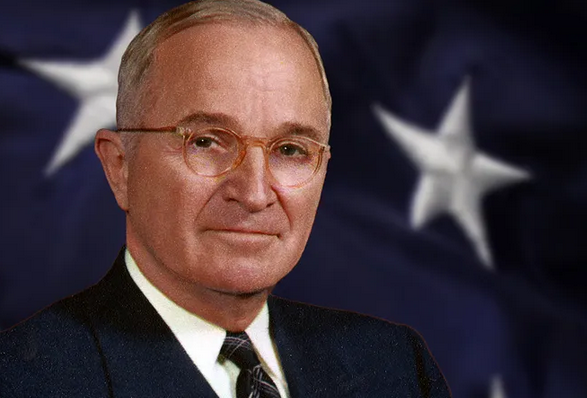

The SSB in 1939 merged with the U.S. Public Health Service, the Civilian Conservation Corp and other government agencies to become the Federal Security Agency. In 1846 under President Harry S. Truman the SSB was named the Social Security Administration SSA.

In 1953 the Federal Security Agency was dismantled and the SSA was placed under the banner of the Department of Health, Education and Welfare. Finally in 1994 President Bill Clinton made the Social Security Administration an independent body once again.

Retirement Social Security

Retirement benefits from Social Security are earned through the payment of taxes taken from an individual's paycheck throughout their working life. A minimum of 40 credits are required to qualify for full retirement which equates to around 10 years of full time employment.

How Is the Social Security Benefit Amount Determined?

Ideally the Social Security Administration will look at the top 35 years of earnings to help determine how much a beneficiary will receive monthly in payments. They compute an average indexed amount that factors in the beneficiary's highest earning years and divide the total amount earned in that time by the number of months within those years.

The result average determined from that sum is then rounded down to the next lower dollar amount. This produces the Average Indexed Monthly Earnings (AIME). Using this the Social Security administration will do some complicated math to determine the monthly payment available to the beneficiary based on other individual factors. The maximum possible benefit as of 2023 is $3,627 a month.

When Are Social Security Benefits Paid Out?

Social Security is consistent when it comes to payments, supplying benefits monthly but not on the same day for everyone. The payment date for these types of benefits will usually be on a Wednesday. It will be based on the beneficiary's birthday as shown below:

- Born 1st – 10th of the month: payment is the second Wednesday of the month

- Born 11th – 20th of the month: payment is the third Wednesday of the month

- Born 21st – 31st of the month: payment is the fourth Wednesday of the month

There are certain circumstances under which payments will come on the 3rd of the month and not based on the birth date of the recipient these are:

- The benefits were first filed for before May 1st, 1997

- The beneficiary also receives supplemental security income (SSI) payments

- Medicare premiums are paid for by the state in which the beneficiary lives

- The beneficiary no longer lives in the United States

The normal payment date of these benefits falls on a federal holiday meaning the payment will shift to the first weekday prior to that holiday.

Social Security Disability Insurance (SSDI)

This program was created to take care of tax paying citizens or legal residents who have contributed to Social Security through the payment of taxes should they become unable to work any longer. This generally kicks in prior to retirement age and does so because an individual has become unable to work due to a physical or mental disability.

How are SSDI Payments Calculated?

Some may have heard that benefits for disability may be based on the severity of the applicant's condition but this is in no way a determining factor. Just like retirement benefits it comes down to lifetime average earnings prior to the disability occurring.

The amount of benefits will be determined on a person's average covered earnings up until the first full year prior to them becoming disabled. If an individual has been able to contribute the maximum into the Social Security system then they would be eligible for a payment as much as $3,627 a month.

When Are SSDI Benefits Paid?

Social Security Disability Insurance is consistent when it comes to payments, supplying benefits monthly but not on the same day for everyone. The payment date for these types of benefits will usually be on a Wednesday. It will be based on the beneficiary's birthday as shown below:

- Born 1st – 10th of the month: payment is the second Wednesday of the month

- Born 11th – 20th of the month: payment is the third Wednesday of the month

- Born 21st – 31st of the month: payment is the fourth Wednesday of the month

There are certain circumstances under which payments will come on the 3rd of the month and not based on the birth date of the recipient these are:

- The benefits were first filed for before May 1st, 1997

- The beneficiary also receives supplemental security income (SSI) payments

- Medicare premiums are paid for by the state in which the beneficiary lives

- The beneficiary no longer lives in the United States

The normal payment date of these benefits falls on a federal holiday meaning the payment will shift to the first weekday prior to that holiday.

Supplemental Security Income (SSI)

The Supplemental Security Income program provides cash payments to disabled adults, disabled children and seniors over 65 years old. It is a means-tested program meaning that eligibility is dependent on the applicant's income.

This program is open to citizens or nationals of the United States and unlike SSDI you do not need to have a history of paying Social Security taxes. This is because individuals who apply may never have worked due to their disabilities or some other reason.

This was a system that was created to replace federal-state adult assistance programs. These programs served the same purpose but were state specific. As these original state programs were inconsistent in their eligibility requirements they received a great deal of criticism.

How Is SSI Calculated?

The Supplemental Security Income program is intended for individuals who have not been able to contribute to the Social Security system but still require help. This means it is a set amount rather than something which changes depending on the individual. Its calculation depends on the current cost of living adjustment (COLA).

As of 2023 this means an individual will receive $914 per month while an eligible couple makes $1371 a month. Starting in 2024 this will increase to $943 for individuals and $1415 for married couples.

When Do SSI Payments Arrive?

According to the Social Security Administration SSI benefits are paid on the 1st of the month, every month. This is true unless the 1st happens to fall on a weekend in which case the Friday prior to the 1st becomes the new date. So for example if November 1st falls on a Sunday then the SSI payment for November will be paid Friday the 30th of October instead.

Final Thoughts

Understanding how much and when you will receive Social Security payments can be complicated but not impossible to understand. There are some guidelines that Social Security follows and sometimes these may change but as of 2023 the information in this article is correct and accurate.

Reference SSA Locator

If you use any of the forms, definitions, or data shown on SSA Locator, please make sure to link or reference us using the tool below. Thanks!

-

<a href="https://ssalocator.com/blog/the-complete-guide-to-social-security-payments/">The Complete Guide to Social Security Payments</a>

-

"The Complete Guide to Social Security Payments". SSA Locator. Accessed on July 27, 2024. https://ssalocator.com/blog/the-complete-guide-to-social-security-payments/.

-

"The Complete Guide to Social Security Payments". SSA Locator, https://ssalocator.com/blog/the-complete-guide-to-social-security-payments/. Accessed 27 July, 2024

-

The Complete Guide to Social Security Payments. SSA Locator. Retrieved from https://ssalocator.com/blog/the-complete-guide-to-social-security-payments/.